A System and Method for Valuation, Acquisition and Management of Insurance Policies

ORLANDO, September 12, 2018 / — RiskMD is granted a patent for “System and Method for Valuation, Acquisition and Management of Insurance Policies”. The patent focuses on acquiring, valuing and managing workers’ compensation client company exposures regardless of the insurance policy structure. This is the first Professional Employer Organization (“PEO”) specific patent ever issued. Since its inception in 2005, RiskMD has been focused on understanding the diagnostics of the prospective or current coemployed client companies of a Professional Employer Organization (“PEO”) within the overall portfolio of client companies of that PEO. In order to understand what client companies fit the given portfolio and at what price, we partnered with Appulate to efficiently acquire client data to then apply a proprietary predictive model called “The Barnstable Vintage” to value and thereby price the client company in question. The vision was “Geico meets workers’ compensation”; acquisition, underwriting, valuation and pricing of a client company based on a pure computer feed with underwriter input only on an exception basis as is shown in exhibit 1 of the patent:

Since its inception in 2005, RiskMD has been focused on understanding the diagnostics of the prospective or current coemployed client companies of a Professional Employer Organization (“PEO”) within the overall portfolio of client companies of that PEO. In order to understand what client companies fit the given portfolio and at what price, we partnered with Appulate to efficiently acquire client data to then apply a proprietary predictive model called “The Barnstable Vintage” to value and thereby price the client company in question. The vision was “Geico meets workers’ compensation”; acquisition, underwriting, valuation and pricing of a client company based on a pure computer feed with underwriter input only on an exception basis as is shown in exhibit 1 of the patent:

While there will always be a place for underwriters and underwriting, the consistency of process in acquiring and valuing business is intended to focus the underwriter on the “art” versus “science” of underwriting. How long in business? Good neighborhood? Does the owner throw birthday parties for their staff? This is the art and the mathematical formulas behind the predictive models built provide the science.

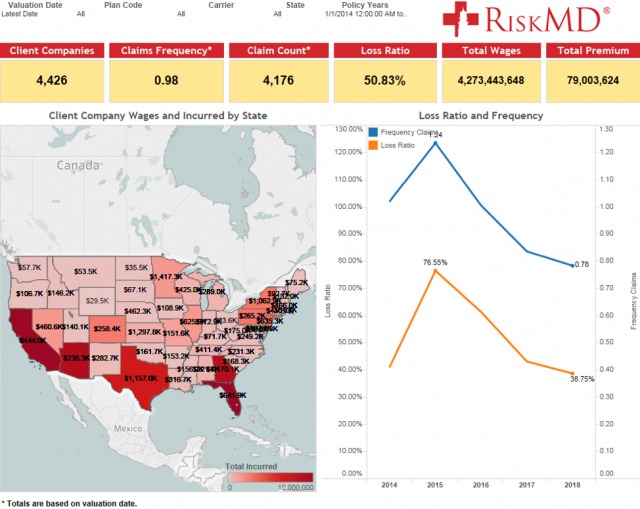

In an effort to properly manage client companies of a PEO regardless of policy structure, the last piece was to understand and then to build a process revolving around a key identifier; the client company Federal Employer Identification Number (“FEIN”). Cathy Doss, the first Chief Data Officer for Capital One and current Data Officer for Fannie Mae, architected a similar process at Capital One with the Social Security Number as the key identifier and created a similar process for RiskMD. The combination of these processes are what provides the foundation for this patent and the vision of RiskMD. The end result is the ability to spin data amongst the three main data pools of a PEO; policy/application data, claims data and payroll/premium data. Using Tableau as a visualization tool behind the SQL built mathematical formulas, the end presentations look like the below.

Unlocking PEO client data to make more informed decisions is foremost in understanding how to acquire, value and properly manage insurance policies and the client companies that they insure. We are passionate about proving out the value and performance of the PEO industry and know that this now patented process will help immensely to that end. We appreciate all of our clients and carriers support on this effort over the last five years and look forward to further deployment of this tool to the betterment of each party and the industry as a whole.

“The vision of RiskMD was to make data-driven decisions in pricing and managing PEO client companies regardless of policy structure”, said Mr. Hughes. “Too much time was being spent diagnosing issues and not enough in treating them. While our now patented process has been in place for years, it is very satisfying to be recognized by the United States Patent Office for the invention”.

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.

All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.

To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.