NCCI is recommending a sizable rate decrease for Tennessee at -19%. If approved, the decrease will be effective 3/1/19. See more information below from Insurance Journal.

——

The National Council on Compensation Insurance (NCCI) has filed for a 19.1 percent decrease for workers’ compensation voluntary market loss costs in Tennessee – the largest recommended decrease since reforms to the state’s workers’ compensation system were passed in 2013.

The filing, made towards the end of August, is based on premium and loss experience for policy years 2015 and 2016, according to a filing executive summary released by NCCI. If approved the rates would go into effect March 1, 2019.

NCCI said the proposed decrease is attributed in part to a continued decrease in Tennessee’s lost-time claim frequency. NCCI also noted that both indemnity average cost per case and medical average cost per case have remained “relatively stable” in recent years after adjusting to a common wage level.

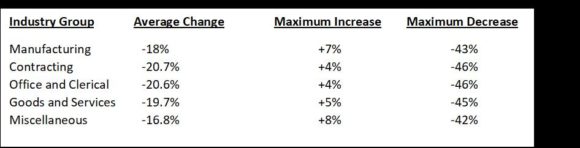

The proposed changes in voluntary loss cost level by industry group are as follows:

If approved, the rate decrease would be the eighth consecutive reduction in workers’ compensation rates. Last year, NCCI filed for a rate reduction of 12.6 percent and a 12.8 percent reduction was approved in 2016. Insurance carriers combine NCCI’s loss cost filings with company experience and expenses to develop insurance rates. In 2017, the Tennessee Department of Commerce & Insurance noted that since Tennessee introduced significant changes to its workers’ compensation system in 2014, NCCI filings have totaled loss cost reductions of more than 36 percent.

The workers’ compensation reforms that took effect in 2014 included the creation of a new administrative court system to handle workers’ compensation claims – moving the state’s claims process from a tort system to an administrative one. The reforms also established medical treatment guidelines and provided a clearer standard in determining to what degree an injured worker’s medical condition may have contributed to the cause of an on-the-job injury.

In June, a study by the Workers Compensation Research Institute (WCRI) attributed a drop in the average total cost per workers’ compensation claim of 6 percent in 2015 in part to the state’s workers’ comp system reforms.

“Most of the 6 percent decrease in the average total cost per workers’ compensation claim in Tennessee was from a 24 percent decrease in permanent partial disability (PPD) benefits. Total costs per claim incorporate payments for medical treatments, indemnity benefits, and expenses to manage claims,” said Ramona Tanabe, WCRI’s executive vice president and counsel, said in a statement at the time.

The WCRI study, which compared Tennessee workers’ compensation systems in 17 other states, also noted that worker attorney involvement has decreased in recent years and that time to first indemnity payment within 21 days of injury in Tennessee was similar to the other study states during 2016/2017. The study used claims data with injuries dating back to Oct. 1, 2014, and payments made through March 31, 2017.

Insurer trade group the Property Casualty Insurers Association also noted the impact the 2013 reforms have made in the state.

“Tennessee has had excellent financial results in the workers compensation market following the workers compensation reforms of 2013,” said Jeffrey L. Brewer, vice president of PCI Public Affairs. “Claims frequency continues to decline as a result of automation and improved employer safety programs. Loss costs appear to be stable.”

A spokesperson for TDCI said in an e-mail to Insurance Journal that it would be premature for the department to comment on the potential for a rate reduction given that the figures are preliminary and still need to be examined by actuaries. Commissioner Julie Mix McPeak has 90 days from the filing date to make a decision on the filing.

Join the Conversation on Linkedin | About PEO Compass

The PEO Compass is a friendly convergence of professionals and friends in the PEO industry sharing insights, ideas and intelligence to make us all better.

All writers specialize in Professional Employer Organization (PEO) business services such as Workers Compensation, Mergers & Acquisitions, Data Management, Employment Practices Liability (EPLI), Cyber Liability Insurance, Health Insurance, Occupational Accident Insurance, Business Insurance, Client Company, Casualty Insurance, Disability Insurance and more.

To contact a PEO expert, please visit Libertate Insurance Services, LLC and RiskMD.